views

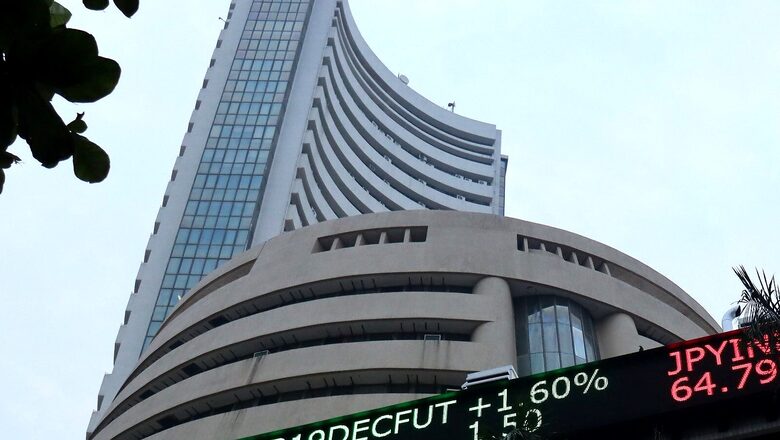

The benchmark index BSE Sensex on Thursday, at 1248 hours IST, was trading at 59,007.04, up 293.87.68 points, or up 0.45 per cent. The Sensex rallied and crossed 59,000 mark for the first time. At the same time broader Nifty was trading 17,583.60, up 64.15 points, or 0.37 per cent.

In early trade, The benchmark index BSE Sensex on Thursday opened in green at 58,852.04, up 128.84, or 0.22 per cent. The broader Nifty opened at 17,559.85, up

40.40 points, or 0.23 per cent. After the relief package announced for the telecom sector announced by the government, the scrip of Vodafone India rose by 9.97 per cent. On NSE, IndusInd Bank, BPCL, ITC, Eicher Motor, Tata Steel were the top gainers. On the other TCS, Titan, NTPC, Shree Cement, HDFC were among laggards. 39 shares advances, 11 declined keeping the market breadth positive. Sectorally, Nifty Bank, Nifty Auto, Nifty FMCG, Nifty Realty were trading in the green.

“The clear message from yesterday’s package for telecom industry and PLI scheme for autos is that the government is on fast-forward mode as far as reforms are concerned. This reform initiatives justify the market’s confidence in India’s potential growth and earnings outperformance. The bold reforms in India’s two crucial sectors have the potential to add to India’s GDP growth in the coming years. The timing of the PLI scheme for autos has to be seen in the context of investment leaving China due to regulatory crackdown. India is firmly on the road to become part of the global supply chains for auto industry. The exuberance in the market is partly justified by the bold reform initiatives. The over confidence of the bulls, however, emanates from the lack of any moves on the horizon that will sharply reduce liquidity in the market,” Dr V K Vijaykumar, chief investment strategist at Geojit Financial Services said.

On BSE, Privi Speciality Chemicals, Vodafone Idea, Godfrey Philips are the top performers. On the flip side, National Peroxide Ltd, Zensar Technological Ltd were the losers. BSE MidCap rose by 0.09 per cent and BSE SmallCap rose by 0.02 per cent.

“Benchmark Indices are expected to open on a cautious note as trends on SGX nifty indicates a flat opening with 12 points gains. Shares in Asia-Pacific were mixed in Thursday morning trade, with casino shares in Hong Kong mostly seeing another day of losses. The S&P 500 and Dow Jones Indexes rose on Wednesday on mildly positive factory data and higher oil prices, although concerns over a slowing economic and higher corporate taxes kept sentiment subdued. Tokyo stocks opened higher on Thursday as investors took heart from a Wall Street rebound, with hopes for stimulus under the next government in Japan continuing to support the market. Crucial support for Nifty 50 is 17,400 while Nifty may face some resistance at 17,700,” Mohit Nigam, head – PMS, Hem Securities said.

Indian market factored in the positive global cues and opened with gains, Asian bourses also marched up, the Hang Seng Index inched up 8.82 points to 25,042.03. The Shanghai Composite Index edged up 0.24 percent, or 8.62 points, to 3,664.84, while the Shenzhen Composite Index on China’s second exchange was marginally up, adding 1.09 points, to 2,485.03. On the other hand, Tokyo stocks opened higher on Thursday. The benchmark Nikkei 225 index was up 0.25 percent, or 75.28 points, at 30,586.99 in early trade, while the broader Topix index rallied 0.24 percent, or 5.00 points, to 2,101.39.

Also a raft of decisions taken by the Union Cabinet on Wednesday bolstered up the market sentiment on Dalal Street. A big relief for telecom sector, PLI for auto sector translated into gains for the companies on the bourses, driving the market up.

Read all the Latest News , Breaking News and Ukraine-Russia War Live Updates here.

Comments

0 comment