views

India’s leading public sector lender Punjab National Bank (PNB) has announced that it is set to hike the fees on various non-banking related services from this month, including the number of free transactions each year across various segments. The new rates will come into effect from May 29 this year, PNB has said in a recent notification. PNB has also increased its external benchmark linked lending rate by 0.40 per cent to 6.90 per cent, that is set to come into effect next month. ,

The various charge hikes and transaction limits include the issue of multi-city cheque books, number of free transactions in savings and other accounts, and proposal for revised locker rent charges among others. The move comes a week after the RBI hiked its repo rates by 40 basis points.

Here are the revised PNB service charges that will come into effect from May 29 this year

Savings Account Transaction Limit: While the PNB savings account transaction limit has been hiked, the charges after exceeding the limit has also been hiked. Earlier, the lender used to charge Rs 2 per transaction in a year, after the free limit of 40 transactions in a financial year was crossed. Now, it will charge Rs 10 per debit transaction if you cross the new limit of 50 debit transactions in a financial year.

Cheque Returning Charges: The lender has proposed a new slab for outward returning charges. From May 29, the bank will charge Rs 250 for outward transactions of amounts over Rs 1 lakh and up to Rs 10 lakh. For transactions above Rs 10 lakh, Rs 500 per transaction will be levied. The same will go for outstation charges, plus out of pocket expenses.

Cheque Book Issuance: PNB has said that it will reduce the free cheque book leaves with savings accounts from 25 to 20.

Charges for Locker Rent Penalty: The bank will charge 25 per cent annual rent as penalty for a delay up to one year. For delays more than one year and up to three years, a penalty of 50 per cent of annual rent will be levied, while for delays more than three years the bank will break open the locker.

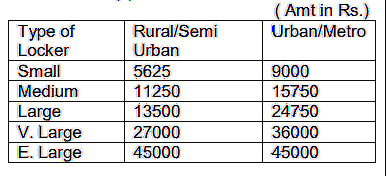

Incentivise Payment of Advance Locker Rent for 5 years: Following are the “Proposed Rent Slab in case Advance Locker rent for a period of five year is deposited by Locker Holder(s)”

It must be noted that the above rent slab is excluding premium of 25% in identified Metro branches. In case Locker holder surrenders the locker before expiry of period of five year for which advance rent has been paid, then locker rent on annual card rate basis shall be charged.

Charges for Current, Cash Credit, Overdraft and Other Accounts: Based on an amount of Up to Rs 1 lakh per day, the charges will be free. For transactions above Rs 1 lakh, Re 1 per thousand will be charged, subject to minimum Rs 10 and maximum Rs 30,000.

Read all the Latest Business News here

Comments

0 comment