views

LIC Jeevan Labh Policy: The Life Insurance Corporation, or LIC, of India is one of the go-to options for Indians when it comes to buy insurance policies. The LIC, has for this reason, curated specific plans for a specific group of individuals. The corporation, backed by the government has an array of insurance plans for people of almost all ages and categories. LIC policies are loved among Indians who like investing in risk-free assets, and after bank FDs and post office savings schemes these LIC policies are a favourite among them due to is comparatively high returns. The fact that the interest rate is not dependent on stock market movement also makes it a favourable option especially when they are volatile like now. LIC Jeevan Labh Policy is one of the most popular policies launched by the company.

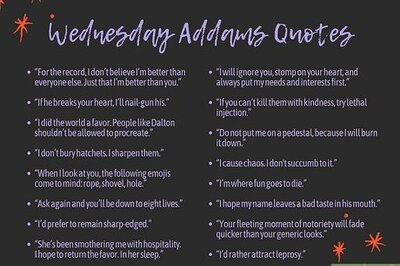

What is LIC Jeevan Labh Policy?

LIC’s Jeevan Labh is a limited premium paying, non-linked, with-profits endowment plan which offers a combination of protection and savings. This plan provides financial support for the family in case of unfortunate death of the policyholder any time before maturity and a lump sum amount at the time of maturity for the surviving policyholder. This plan also takes care of liquidity needs through its loan facility.

LIC Jeevan Labh: Features and Eligibility

The minimum sum assured under this LIC Jeevan Labh policy is Rs 2 lakh. One can pay the premiums for 10, 15 and 16 years and get the maturity amount after 16 to 25 years depending on the tenure of premium paid. The minimum age of availing the LIC Jeevan Labh Policy is eight years, while the maximum age of entry is 59 years, for a 16 year maturity term. This means that the policyholder should not be older than 75 when the LIC Jeevan Labh plan matures.

LIC Jeevan Labh Policy Benefits

There are a host of benefits of the LIC Jeevan Labh Policy. On maturity of the policy, if the policyholder is alive, the basic sum assured, along with vested simple reversionary bonuses and final additional bonus, if any, will be payable in lump sum on survival to the end of the policy term provided all due premiums have been paid. On the other hand, if the policyholder does not survive, the nominee will get the sum assured on death, which is seven times higher than the absolute amount assured.

LIC Jeevan Labh Policy Calculator: Invest Rs 253 Daily, Get Rs 55 Lakh at Maturity

If you are 25-years-old and avail the LIC Jeevan Labh policy for a 25-year maturity period, then you will be eligible to get as much as Rs 54.50 lakh at maturity. You have to select Rs 20 lakh as the basic sum assured and have to pay Rs 92,400 as a yearly premium, which is roughly equal to Rs 253 per day. After 25 years, the total maturity value will be Rs 54.50 lakh. This way, your small investment can go a long way under the LIC Jeevan Labh policy.

Read all the Latest News , Breaking News , watch Top Videos and Live TV here.

Comments

0 comment